A GST enrolled seller must give GST Invoice/GST Bill to customers in the event that he is providing available merchandise or administrations. GST Invoice gave must be consistent with the GST rules and guidelines for all gracefully of merchandise and enterprises. Normally, a receipt is given to charge just as to guarantee Input tax reduction.

GST Billing and Invoicing are made simple and straightforward with GST Billing programming. A receipt can be produced according to GST rules and gave to clients rapidly. Let us find in detail what are the compulsory fields of a GST Invoice/Bill according to the GST Rules.

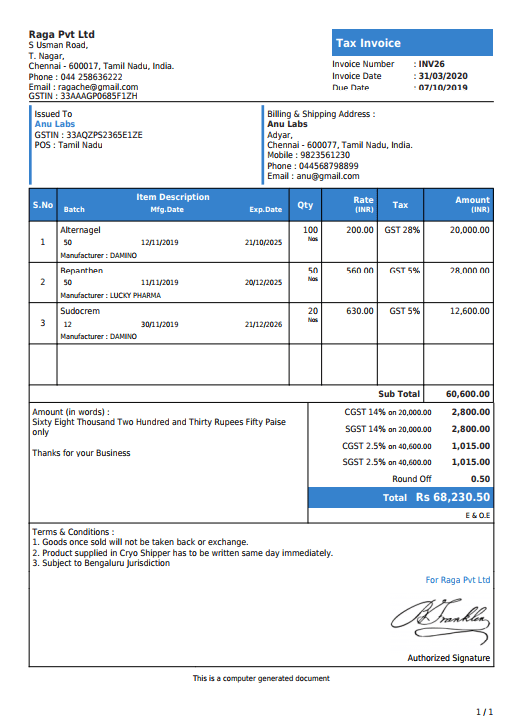

GST Invoice Format

A point by point proficient Tax Invoice under GST must comprise of the accompanying required fields:

Name, Address, and GSTIN of the provider

Receipt number(Unique chronic number related to monetary year)

Date of giving Invoice

a) Name, Address, and GSTIN of the customer(if enrolled)

b) Name, Address, Delivery address with state name and code(if unregistered and charge esteem more than Rs.50000)

HSN code of goods or Accounting Code of administrations

HSN is likewise not needed if turnover is beneath 1.5 crores. In the event that turnover is between 1.5 crore to 5 crores, just 2 digits of HSN code is required. Yet, on the off chance that turnover is over 5 crore, at that point, 4 digits of HSN code will be needed in solicitations.

GST Invoice Format

Depiction of Goods or Services

Amount and Unit (if there should be an occurrence of products)

Absolute Value of flexibly of merchandise or administrations alongside discount(if any)

Assessment Rate

The measure of an assessment charged in regard to available products or administrations

Spot of Supply

Conveyance address(if contrasts from Place of Supply/Billing Address)

Regardless of whether the expense is payable or the opposite charge

A signature or Digital Signature of the provider

If there should arise an occurrence of fare of products or administrations, a receipt will convey an underwriting, for example, “Gracefully Meant for Export on Payment of IGST” (as per the receipt type) alongside the name, address, conveyance address, nation name, number and date of use for the expulsion of merchandise for sending out.

Time Limit to give Invoice – Invoicing Under GST

According to the GST Act, there is a period breaking point to give solicitations dependent on the flexibly of merchandise/administrations.

On account of flexibly of merchandise:

Expense receipt must be given previously or at the hour of

Expulsion of merchandise for providing to the beneficiary, where gracefully includes the development of products.

Conveyance of merchandise to the beneficiary, where gracefully doesn’t need the development of products.

Issue of record installment/proclamation where there is a constant gracefully.

On account of gracefully of administrations:

Assessment Invoice must be given within 30 days from the date of gracefully of the administration

Assessment Invoice must be given inside 45 days from the date of gracefully of the administration where the provider is a bank or monetary foundation.

A nitty-gritty expert Tax Invoice under GST must comprise of the accompanying obligatory fields:

Name, Address, and GSTIN of the provider

Receipt number(Unique chronic number related to monetary year)

Date of giving Invoice

a) Name, Address, and GSTIN of the customer(if enrolled)

b) Name, Address, Delivery address with state name and code(if unregistered and charge esteem more than Rs.50000)

HSN code of goods or Accounting Code of administrations

HSN is likewise not needed if turnover is underneath 1.5 crores. In the event that turnover is between 1.5 crore to 5 crores, just 2 digits of HSN code is required. Be that as it may, in the event that turnover is over 5 crore, at that point 4 digits of HSN code will be needed in solicitations.

The portrayal of Goods or Services

Amount and Unit (in the event of products)

Complete Value of flexibly of products or administrations alongside discount(if any)

Duty Rate

The measure of expense charged in regard to available products or administrations

Spot of Supply

Conveyance address(if varies from Place of Supply/Billing Address)

Regardless of whether the duty is payable or the opposite charge

A signature or Digital Signature of the provider

If there should be an occurrence of fare of products or administrations, a receipt will convey support, for example, “Gracefully Meant for Export on Payment of IGST” (as indicated by the receipt type) alongside the name, address, conveyance address, nation name, number and date of use for the expulsion of merchandise for trade.

Time Limit to give Invoice – Invoicing Under GST

According to the GST Act, there is a period cutoff to give solicitations dependent on the gracefully of merchandise/administrations.

On account of gracefully of products:

Duty receipt must be given previously or at the hour of

Expulsion of merchandise for providing to the beneficiary, where gracefully includes the development of products.

Conveyance of merchandise to the beneficiary, where gracefully doesn’t need the development of products.

Issue of record installment/articulation where there is a consistent gracefully.

On account of gracefully of administrations:

Assessment Invoice must be given within 30 days from the date of flexibly of the administration

Expense Invoice must be given inside 45 days from the date of gracefully of the administration where the provider is a bank or budgetary organization.

Bill of Supply

Bill of Supply is like GST receipt however it doesn’t contain charge sum since it is raised for excluded merchandise/administrations.

Bill of flexibly is given by an enrolled provider in the accompanying cases:

Gracefully of excluded products/administrations.

Provider picked/goes under Composition conspire.